Tariffs explained: What they may mean for Arizona's retail and logistics industries

There’s been a lot of speculation about how changes in U.S. tariff policy might affect retailers and their customers. Could we see higher prices? Disruptions to the supply chain? What about jobs?

In the second article of our “Tariffs explained” series, we’re taking a look at the complex relationship between tariffs and the retail industry – and potential effects on Arizonans.

Do higher tariffs equal higher prices?

Probably, though price increases will likely vary from retailer to retailer – or even product to product.

Kathleen J. Kennedy, a professor of practice specializing in retailing and consumer science at the Norton School of Human Ecology, explained that in general, when tariffs are placed on goods, consumer prices increase.

“To put it in terms of basic economic concepts, tariffs affect supply because they make it more expensive for retailers to bring products into the country,” she said. “Retailers are faced with either importing fewer products for the same cost, or paying more to bring in the same volume of products. When we affect supply in those ways without changing demand, that puts upward pressure on prices.”

But it isn’t that simple.

Kennedy explained that retail prices reflect an extremely complex web of factors, including the cost of basic materials, labor to produce those materials, labor to assemble a final product, a supply chain that often crosses and re-crosses many borders along the way, and the logistics involved in getting products to consumers. The potential for increased tariffs adds another layer of complexity to retailers’ calculations as they make their pricing decisions.

Large retailers likely have an advantage when it comes to mitigating potential tariffs’ upward pressure on prices, according to Cory Quailes, an associate professor of practice in retailing and consumer science at the Norton School of Human Ecology.

"A large retailer has a lot more negotiation power, so they could certainly pressure their suppliers to absorb some of the cost of increased tariffs,” he said. “Mom-and-pop retailers are more likely to have to accept that suppliers may charge them more money to cover their increased cost to bring the products into the country.”

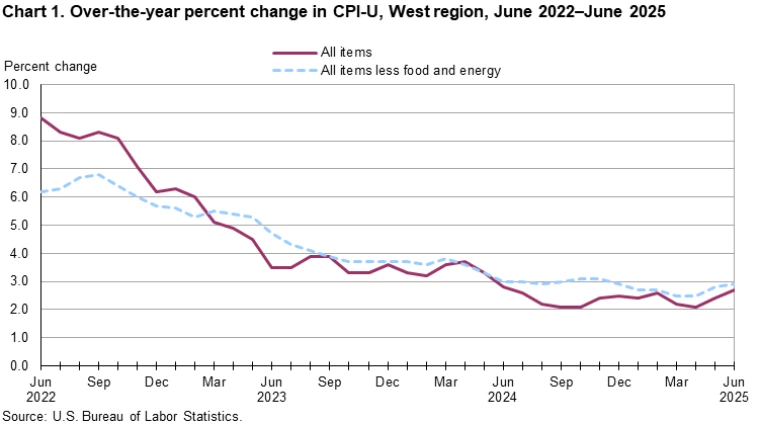

So far in 2025, retail prices in most sectors have remained fairly stable. According to the U.S. Bureau of Labor Statistics, consumer prices rose only 2.7% between June 2024 and June 2025.

The Consumer Price Index for All Urban Consumers (CPI-U) for the West Region - which includes Arizona - increased 2.7% for the 12 months ending in June 2025.

The U.S. Bureau of Labor Statistics

Kennedy said this is likely because retailers were able to prepare for increased costs due to tariffs.

“In the first quarter of 2025, we saw retailers do something that was really unusual,” she said. “They pre-purchased enormous amounts of inventory at pre-tariff prices in the hopes that tariffs will come down before stock runs out. That’s good for consumers because it helps retailers keep prices down.”

She noted that consumer behavior early in 2025 might also be contributing to keeping retail prices lower than expected.

“We’ve seen some early signs that consumers have pulled back a bit on spending as a result of uncertainty about the economy,” she said. “That reduced demand, coupled with the temporary increase in supply, would tend to keep prices from rising in the short term.”

The long-term outlook is harder to predict.

“We have large retailers who’ve made provisions to deal with tariffs, so we’re not going to see dramatic things right away,” Kennedy said. “We’re going to see smaller things, and those are hard to predict at this point because things are still very much in flux.”

Are higher tariffs likely to lead to shortages?

Kennedy doesn’t expect empty store shelves like we saw at the height of the Covid-19 pandemic, but there may be a reduction in the variety of products offered.

“For example, it’s back-to-school shopping season now,” she said. “People may not see a lack of backpacks, but maybe a hole in the assortment – maybe there aren’t any blue backpacks.”

Quailes agreed that for nonperishable goods like clothing, shortages probably won’t be a problem – but it may be a different story for groceries.

“If consumers can’t get a tee shirt in a specific color, that’s not going to be the end of the world for them,” he said. “I think the issue lies more in perishable goods, like food. You can’t pre-buy fresh produce, dairy or meat and store it indefinitely because it spoils. So food is going to be much more sensitive to potential disruptions due to tariffs. That could mean higher food costs or shortages, or both.”

How would increased tariffs affect jobs?

As with prices and potential shortages, the effect of tariffs on the Arizona labor force is complex.

Kennedy said there are signs that tariffs – and the uncertainty surrounding them – have already begun to affect retail workers.

“A reduction in consumer spending early in the year has caused there to be a need for fewer retail workers,” she said. “If substantially increased tariffs are implemented, it’s probable that we’re going to see a further reduction in the retail labor market.”

She said that smaller, independent retailers are likely to feel the effects first – but even larger companies may be forced to make difficult decisions.

“Many retailers operate with margins that are shockingly low – 2.5% to 3.5% - and those are already under pressure from the uncertainty of the current situation,” she said. “At the end of the day, the price a consumer pays may not cover the costs throughout the whole supply chain – including the manufacturers, the distribution and the retailers. But if it doesn’t cover all those costs, businesses all along the supply chain will lose money, and some might have to reorganize – or even go out of business.”

While retail may suffer, there is a potential upside for jobs in the logistics industry, which is tasked with distribution and warehousing of goods – and one that’s seeing a lot of growth in Arizona.

“In Arizona, three of our cities – Phoenix, Tucson and Yuma – are terminus points for products going from suppliers to retailers, or retailers to consumers,” Kennedy said. “With the inventory buildup due to retailers pre-buying product and consumer pullback on purchasing, it may mean that new jobs will need to be created in distribution and warehousing.”

Kennedy cautioned that any increase in logistics jobs may be temporary, though, as retailers run through their existing, pre-tariff stock.

How is uncertainty affecting retail?

Quailes said that uncertainty is hard on any business, but it can be especially hard on retailers because of long production cycles that aren’t especially nimble when things change quickly.

“Retail buyers generally place orders with manufacturers months before the product is on the sales floor,” he said. “Once orders are in, it takes weeks – if not months – to produce the goods. Then, if you want to save money by putting them on a boat, it’s going to take another few weeks to another few months before you have it in hand.”

He gave the example of how tariff uncertainty might affect that staple item of many wardrobes: the classic plain tee shirt.

“If I’m a retail buyer placing orders for tee shirts, I might go ahead and place an order for a ton of black shirts, white shirts – the kinds I know will sell - before tariffs go any higher,” he said. “But then, it’s a question of whether you’ve got the ability to store all that inventory, and for how long. Or you could wait to see what happens with tariffs and bring in products when it gets closer to the time you want to sell them, but then you may have to pay to fly them in instead of shipping them by boat.”

Quailes said that while tariff policy is up in the air, it’s a gamble either way: “You’re basically taking a lot of bets as a retailer right now.”